High Danger Vs Reduced Risk Vendor Accounts

Our exclusive on-line application software was developed with ease and simplicity in mind, not annoying or vague like the others. It only takes a few mins and also calls for some standard details. In the time it takes you to make your early morning coffee you can send your application as well as allow us obtain you started with your high risk merchant account. When you companion with a high-risk seller account provider, your account will certainly never be suspended without prior intimation. Actually, you will have 24/7 accessibility to your account to ensure that you can run your organization with no drawback.

Will Take-Two Disappoint Investors on Monday? - Nasdaq

Will Take-Two Disappoint Investors on Monday?.

Posted: Sat, 06 Aug 2022 11:31:51 GMT [source]

Losses like chargebacks are amplified when the business offers costly product and services. Also if a business is thought about low risk by all various other criteria, accepting card-not-present transactions inherently postures a higher risk of fraud and also chargebacks. Most merchant accounts are set up on the condition that your chargeback proportion does not exceed 0.9%. If you look at this amount, then you might well have your account automatically ended. As your high threat seller cpu, we help you safe repayment handling so your service can expand and thrive.

Overview To High Threat & No Debt Check Uk Vendor Accounts

We prepare prices as reduced as 1.4% via strong and risk-free services, no matter where your organization is geographically situated. Your company is considered high threat as well as you're forced to locate a new partner that concentrates on high risk merchant accounts. If a company doesn't comply with the guidelines and regulations, they can be fined or closed down. This postures a better danger to seller account carriers, which is why services in these sectors are typically considered high risk. Products, services, and shipment times additionally can create an organization to be identified as a high threat seller. For example, high ticket sales and high-volume vendor accounts can provide a greater threat for chargebacks than reduced tickets or low volume accounts.

- Unfortunately, this is not the instance for high-risk businesses.

- As you can likely currently presume, these chargebacks are the most common because they are extremely difficult to negate.

- PaymentCloud does charge a repayment entrance fee of $25 each month.

- PaymentCloud is a good option for risky merchants in a range of industries, from credit repair work to dating sites, specifically those with a high volume of month-to-month sales.

- For instance, ecommerce as well as MOTO sellers are greater risk compared to retail sales.

That's why at Bambora, we do not immediately decline merchants in markets that are generally considered high risk. Even account suppliers that concentrate on high-risk sellers do not accept all businesses. If you're an offshore company, have very inadequate credit report or operate an especially higher-risk company, look for vendors that cater especially to your scenarios. The greater the risk is, the more difficult it will certainly be to discover a standard bank or settlement processing provider, yet numerous suppliers concentrate on offering risky organizations.

Pdq Machines: Low-cost Chip & Pin Card Payment Terminals From ₤ 19

MerchantScout uses international high threat card handling services for a wide variety of industries, with a substantial worldwide obtaining network of handling and also banking partners. With a network of over 40 settlement service providers and tested acquiring banks, we allow your service to get a merchant center and get to all potential consumers! It is, as a result, essential that companies in high-risk markets discover a seller account service provider that is experts in their sector. These companies have the risk cravings that's called for to run in these sectors. Club that with a better understanding of the nuances, as well as thus much more adaptable terms.

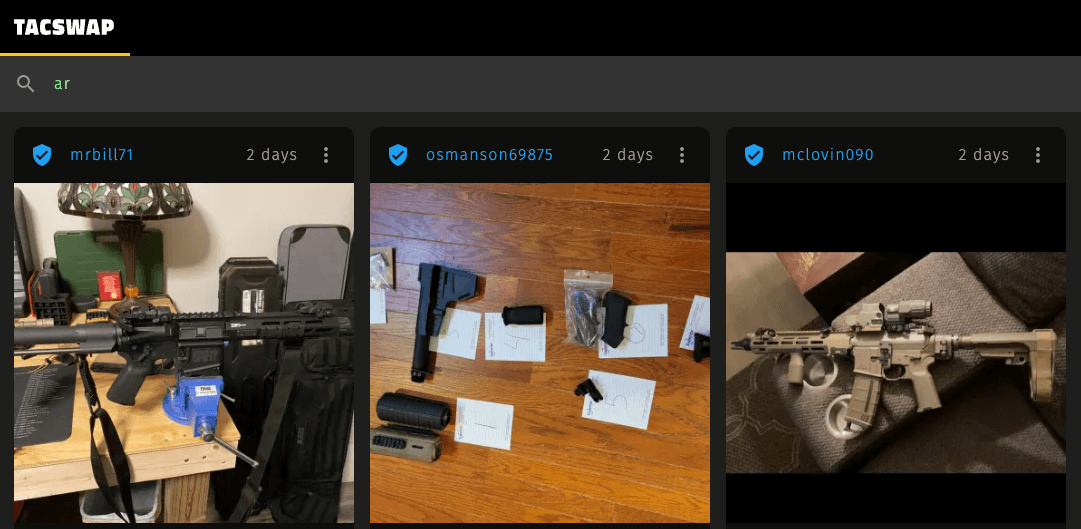

Can you use Square for firearms?

A look at Square's fine print does indicate that they do not accept firearms businesses for credit card processing… From SquareUp.com: “Prohibited Goods and Services include … Sales of (i) firearms, firearm parts or hardware, and ammunition; or (ii) weapons…”

There were several actions to adhere to yet my consultant and also I were able to finish each request expeditiously. A vital step was to provide all required details as well as documentation concerning business and its proprietor. When all due diligence was completed, the process went very smoothly and also to a positive conclusion. I wish to thank this team, and particularly my expert, for their impressive assistance. The high-risk vendor acquirer or the repayment acquirers exchanges the repayment information.

Firms that supply flexible alternatives to satisfy those needs got greater ratings. Attributes we tried to square terminal reader find consist of a reporting dashboard, invoicing, information exports, contactless repayments, chargeback monitoring, quick down payments and overseas account assistance. While this is fairly rare, it can deteriorate your profit margins as well as make you a less enticing prospect to vendor account providers. Having a vendor account enables an account owner to take advantage of vendor cash loan. When a seller is approved for a development, the business accepts receive a round figure of money in exchange for an agreed-upon percentage of future charge card sales.

Is PayPal a merchant account?

PayPal works as a merchant account, but offers much more functionality. Processing credit card transactions through PayPal is more expensive than most other processors. Business loans and lines of credit are also available through PayPal.

This will be useful as the processors might fit with the neighborhood bins as well as local cards. For repayments from Latin America, come close to a South American high-Risk processor. Quadrapay can help you find cpus in various locations consisting of EU, Canada & USA. Instabill is a high-risk seller account specialists and also the riskiest ventures can typically obtain an account established with this UK firm. Instabill isn't the greatest supplier with roughly 12,000 active accounts but it has an excellent online reputation of accepting new vendors as well as taking care of them.

Best Merchant Account Service Providers Of 2022 – Forbes Advisor - Forbes

Best Merchant Account Service Providers Of 2022 – Forbes Advisor.

Posted: Sun, 24 Jul 2022 07:00:00 GMT [source]

Prior to you can start selling your products online, nonetheless, you'll need to setup a secure yet obtainable ecommerce repayment entrance that will certainly improve your clients on-line buying experience. Obviously, these extra services depend on the merchant account provider or the register display risky settlement processor. This industry has a high variety of business disputes and also lawful constraints due to the fact that it brings in many players that have a possibility to devote fraud. Additionally, on-line gaming is high risk due Go to this site to the fact that it can be used for illegal tasks like cash laundering, medicine trafficking, as well as tax obligation evasion. Consequently, it has actually become significantly difficult for companies in this industry to open up a vendor account or utilize payment solutions as a result of the threat entailed for banks.

Who needs a high risk merchant account?

Businesses that are characterized as “high-risk” will need a high-risk merchant account to accept debit and credit card payments. A high-risk business is one that has a greater likelihood of chargebacks or fraud (and certain other characteristics as well).

If you were to look for a vendor represent your high-risk service, a lot of financial institutions would certainly stop at the idea of chargeback and/or regulative dangers. Hence, there is very little interest in supporting high-risk organizations and also authorizing high-risk merchant accounts for services classified as high-risk. When relating to a high-risk merchant companies, it is essential to make your choice knowing you have the best opportunity of having your application accepted at underwriting stage. There are some banks who are dedicated to high-risk markets as well as have a higher appetite to onboard risker organizations.